Banks and financial institutions take complete a series of steps before entering into a new customer relationship by evaluating new customers, banks and financial organizations can avoid engaging with probable criminals.

KYC/eKYC & Risk Assessment

One of these steps is a customer risk assessment, a risk score to find potential customers by gathering and analyzing their information.

Assessment involves calculating a customer’s risk score and classifying customers into three categories:

- low

- moderate

- high

The risk assessment process also details about the behavior of a new customers, including the type and frequency of their transactions. This information helps you monitor transactions and identify suspicious activities, so an adequate customer risk scoring matrix is an essential part of customer onboarding process.

Consolidating Fraud Detection: CFD

Fraud detection is the process of using tools and procedures to prevent the theft of money, information and property. It is a security shield against various forms of fraud. including minor infractions and criminal crimes. Examples of fraud include forging signatures on checks and stealing credit card numbers from millions of account holders.

Anti-Money Laundering: AML

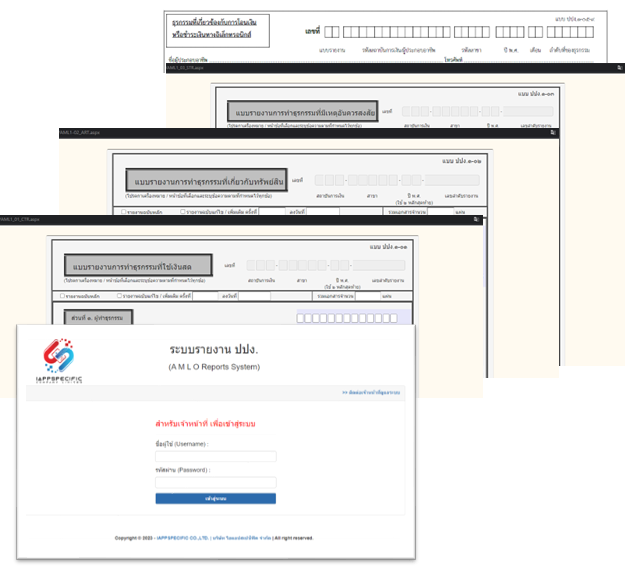

Anti money laundering (AML) refers to Anti-Money Laundering Office (AMLO) is Thailand’s “key agency responsible for enforcement of the anti-money laundering and the counter-terrorism financing law. For laws, regulations, and procedures aimed at uncovering efforts to disguise illicit funds as legitimate income. Money laundering seeks to conceal crimes ranging from small-time tax evasion and drug trafficking to public corruption and the financing of groups designated as terrorist organizations. AML legislation was a response to the growth of the financial industry, the lifting of international capital controls and the growing ease of conducting complex chains of financial transactions.

KEY MODULE

Sanction Screening – Anti Money Laundering (AML) efforts seek to make it harder to hide profits from crime. And criminals use money laundering to make illicit funds appear to have a legitimate origin.

Anti-Money Laundering Report (AMLR) – AML regulations require financial institutions to develop sophisticated customer due diligence plans to assess money laundering risks and detect suspicious transactions.